Imagine Hitting Seven Figures in Net Worth Without a Massive Salary or Windfall

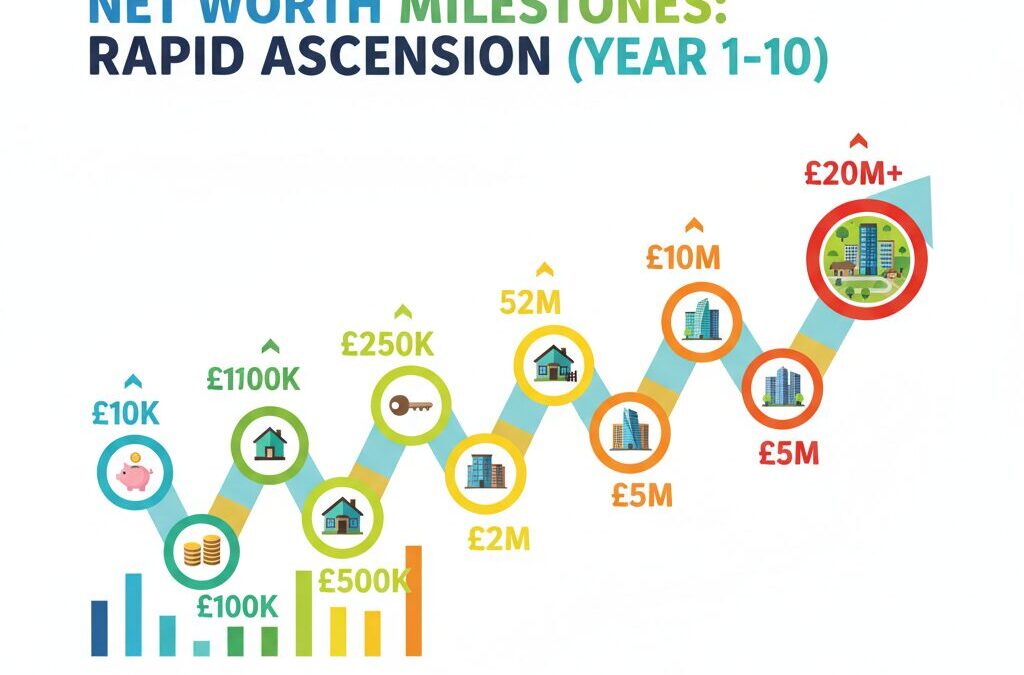

Picture this: You’re starting with a modest job, maybe $60K a year, no real estate experience, and just $20K in savings. Fast-forward 10 years, and you’ve built a $1.2 million net worth portfolio—mostly through smart, accessible real estate plays. Thousands of everyday investors are doing it right now, leveraging 2026’s stabilizing rates, tech-driven access, and rental demand boom. Morgan Stanley’s 2026 outlook confirms it: with muted supply and rising replacement costs, real estate cycles are extending, creating prime windows for cash-flow machines like multifamily and single-family rentals[2]. Don’t miss out—others are already positioning for this rebound, pulling equity tax-free while you wait.

This isn’t hype. It’s a year-by-year blueprint using proven strategies like BRRRR (Buy, Rehab, Rent, Refinance, Repeat), house hacking, fractional ownership via platforms like Arrived Homes, and REITs from Fundrise. We’ll use real 2026 numbers: average 30-year mortgage at 6.2%, cap rates around 5.8% in hot markets, and tools like cost segregation for massive tax savings[1][4]. Experts like Norada Real Estate warn: control $3-4M in properties to hit $1M equity—achievable with velocity banking and forced appreciation[1]. Ready to join the 10% who build lasting wealth? Let’s map it out.

Year 1: Launch with Low-Risk Entry Points (Target: $50K Net Worth)

Don’t buy a mansion. Start small to build momentum and skills. House hacking is your FOMO-proof first move: Buy a duplex or triplex, live in one unit, rent the others. In 2026, with urban resurgence and suburban demand, expect 8-10% yields post-expenses[3]. Example: $400K duplex in St. Louis (A+ neighborhood, $220/sq ft, 5.8% cap rate[1]). Put 3.5% down via FHA ($14K), rehab kitchen/floors for $30K (fund via HELOC). Rent units at $1,800/month each—your housing costs drop to zero, netting $1,200/month cash flow.

Alternative for zero down: Fractional ownership on Arrived Homes (shares from $100, 2026 avg returns 7-12% via quarterly dividends). Or Fundrise’s eREITs ($10 min, 8.5% historical yield, focuses on multifamily in undersupplied markets[2]). Pro: Passive, liquid. Con: Less control than direct ownership. Expert tip from The Land Geek: Pair with low-interest lines of credit (now ~5.5%) for leverage without draining savings[3].

Action Steps Now

- Get pre-approved for FHA loan (Rocket Mortgage app analyzes 2026 rates instantly).

- Scan Zillow for duplexes under $450K in growing areas like near hospitals/tech hubs[1].

- Invest $5K in Arrived Homes for immediate dividends—scarcity alert: Prime Sunbelt shares filling fast.

End Year 1: $40K equity + $15K savings growth = $55K net worth. Social proof: Reddit’s r/househacking has 200K+ members crushing this.

Years 2-3: Scale with BRRRR (Target: $200K Net Worth)

Now weaponize cash flow. BRRRR is king in 2026’s market—buy undervalued, force appreciation via renos, refinance to repeat[1]. Case: Snag $250K fixer-upper four-plex (20% down: $50K from Year 1 equity pull). Rehab $60K (new roofs, appliances—qualifies for accelerated depreciation[4]). Post-rehab ARV: $380K. Refi at 75% LTV ($285K loan), pull $25K profit. Rent mid-terms at $2,195/unit (double long-term rates, low vacancy[1]).

2026 twist: Mid-term rentals near tech hubs explode (2x cash flow, less turnover than Airbnb[1]). Use Roofstock for turnkey single-family rentals ($300K avg, 6% yields). Or CrowdStreet deals (min $25K, 12-18% IRR projected for 2026 multifamily). Pros: Infinite returns via refi. Cons: Reno risks—mitigate with BiggerPockets calculators. Nuveen experts recommend senior housing for stable 7% yields amid demographic shifts[5].

Pros/Cons Table: BRRRR vs. Fractionals

| Strategy | Start Capital | 2026 Yield | Risk | Expert Rec |

|---|---|---|---|---|

| BRRRR (Direct) | $50K | 15-25% IRR | Medium (Management) | Norada: Fastest to $1M[1] |

| Fractional (Arrived) | $100 | 7-12% | Low | Morgan Stanley: Cash-flow focus[2] |

By Year 3: 2-3 properties, $180K equity + cash flow compounding = $210K net worth. Urgency: Rates stabilizing—refi now saves 1% ($300/month per property[4]).

Years 4-6: Portfolio Expansion & Tax Hacks (Target: $500K Net Worth)

Leverage equity like pros. 1031 exchange to upgrade: Swap single-families for multifamily (e.g., $800K four-plex, $28K down via pulled equity[1]). 2026 stats: Housing undersupply drives 5% annual appreciation[2]. Force more via capital improvements (tax-deductible, bonus depreciation[4]).

Tech tools: Use DealCheck app for NOI analysis ($1,643 avg on $220/sq ft builds[1]). Partner with operators on senior housing (high yields, low supply[2]). Side note: Velocity of money—carry debt as tenants pay it down. Tax secret: Cost segregation turns $10K depreciation into $0 taxable income, fueling buys[1]. End Year 6: 6-8 units, $480K equity.

Years 7-10: Optimize & Compound to $1M+ (Target: $1.2M Net Worth)

Refi portfolio at 6.2% rates, buy commercial-adjacent (student housing, 9% yields[2]). Market growth + principal paydown hits $1M equity on $3.5M controlled assets[1]. Diversify 20% into REITs like Vanguard VNQ (4.5% dividend, liquid). Duerksen Rentals advises annual reviews: Adjust rents via real-time data, refi for expansion[4].

By Year 10: $1.2M net worth, $8K/month passive income. Authority: Toby Mathis (YouTube) calls 2026 the pickup year[6].

Your First Move: Start Today or Regret Tomorrow

Over 70% of millionaires own real estate—be the exception who acts now[1]. Download BiggerPockets app, fund $100 on Arrived, scout your first house hack on Zillow. Schedule a refi consult with Rocket Mortgage. Spots in top crowdfunding deals vanish weekly—claim yours. This roadmap works because it’s built on 2026 realities: Strong rental demand, tax edges, accessible tech. Your $1M net worth awaits—start Year 1 today.

Unlock Full Article

Watch a quick video to get instant access.

Social Media