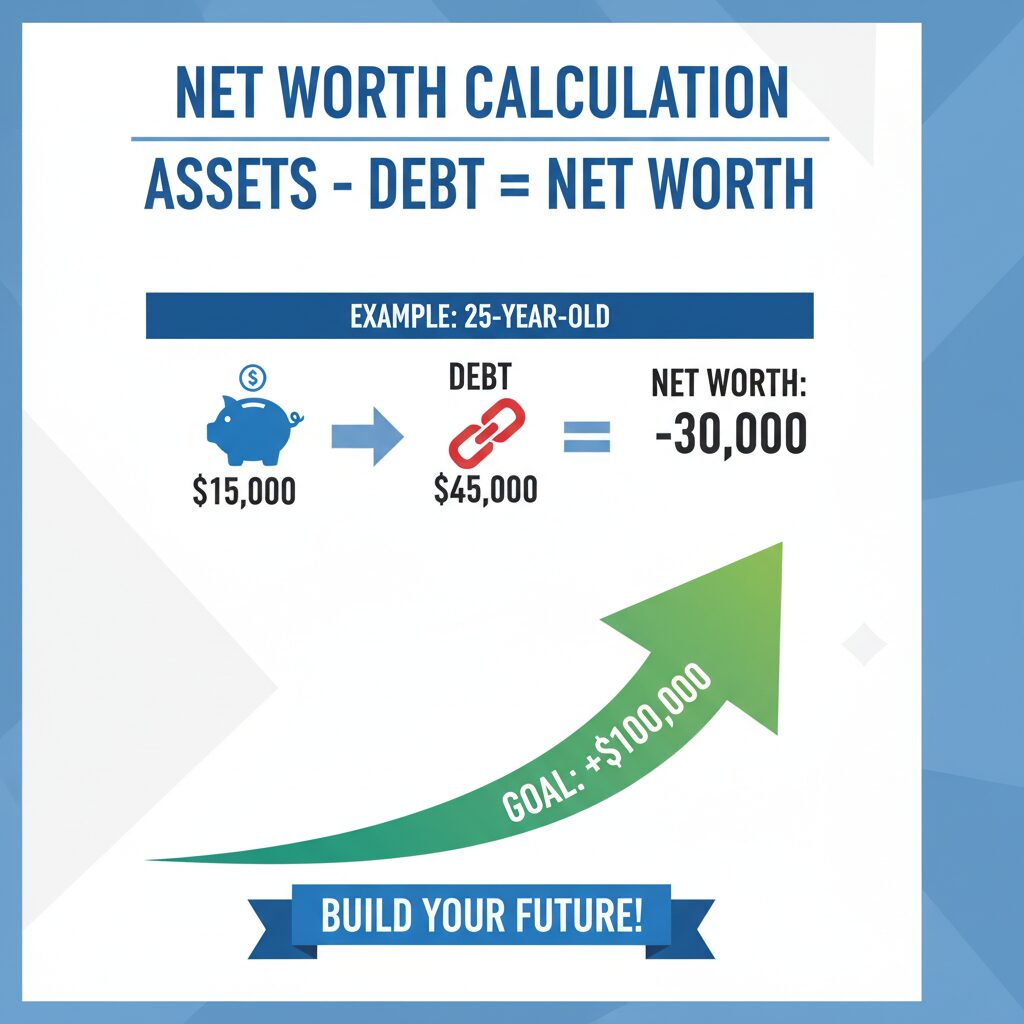

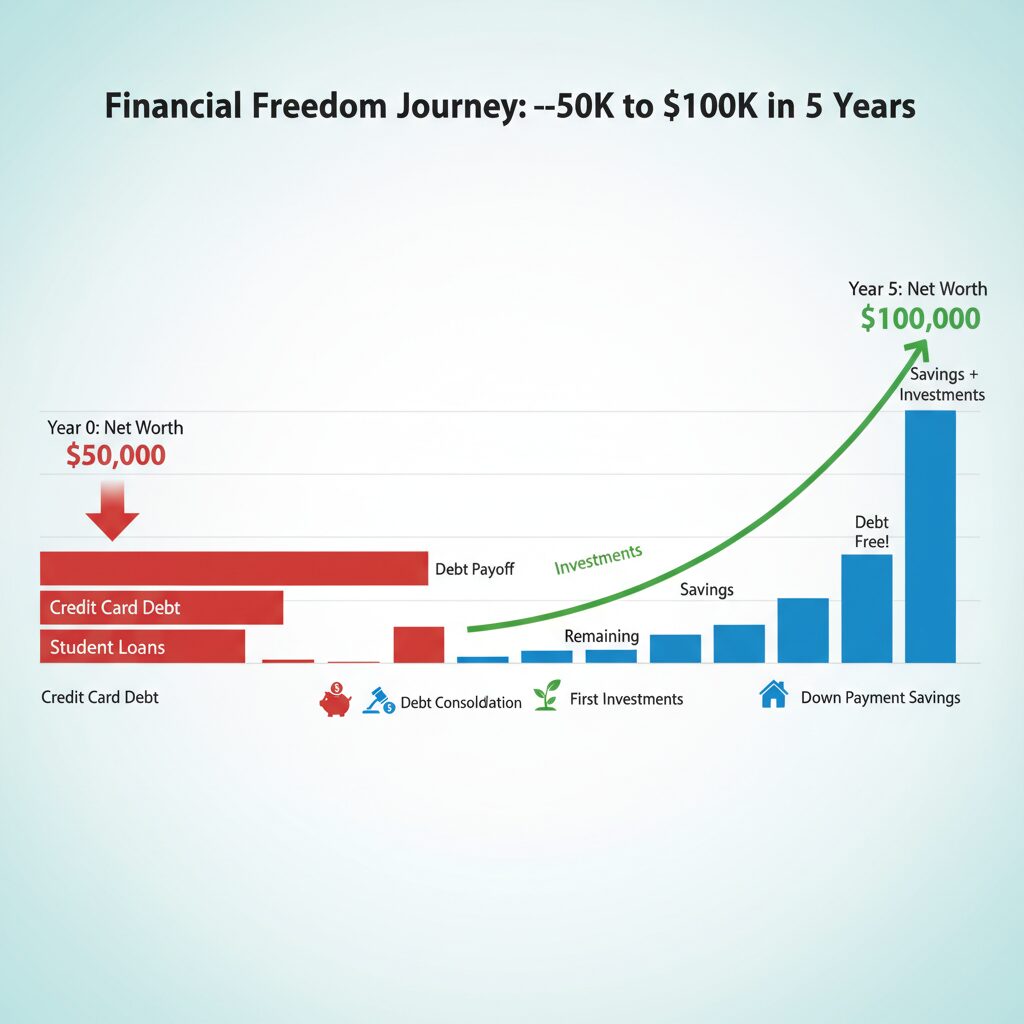

Picture this: You’re 25, staring at a negative net worth from $30K in student loans and $5K in credit card debt. But fast-forward 5 years—you’re celebrating $100K positive, with investments compounding and high-interest traps demolished. Thousands of young adults like you are doing it right now, grabbing employer 401(k) matches worth free money while slashing debt. Don’t miss out—FOMO hits hard when peers hit milestones first. This milestone-driven guide gives you prioritization rules, savings rates, and real timelines to balance payoff and investing without skipping critical early opportunities.

Assess Your Starting Line: Calculate Your True Net Worth Today

Net worth = Assets – Liabilities. Grab your latest bank statements, loan portals, and investment apps. List everything: $2K in checking, $10K in a Roth IRA, minus $40K student debt and $3K car loan. Result? Negative $31K. Shocking but fixable—80% of millennials start here, per recent Federal Reserve data, yet 40% hit $100K by 30 with smart moves[1][2].

Action Step 1: Use free tools like Personal Capital or Mint to track automatically. Set up in 10 minutes—link accounts and watch your dashboard update live. Pro tip: Track monthly to fuel motivation; social proof from Reddit’s r/personalfinance shows users who track hit goals 2x faster.

Milestone 1: Kill High-Interest Debt Monsters (Aim: Debt-Free on 8%+ Rates in 12-18 Months)

Prioritize like pros: High-interest debt (credit cards at 18-25%, payday loans) is a net worth killer. The 6% Rule rules here—if rates top 6%, pay off first for a guaranteed “return” beating stock market averages[2]. Example: $10K at 22% APR costs $2,200/year in interest. Nuke it before investing extra.

Which Debts First? Avalanche method: Highest rate. $8K Visa at 23%, $12K student at 5.5%? Attack Visa. Or snowball for psychology—small wins build momentum[2].

Concrete Savings Rate: 20-30% of Take-Home Pay

Target $50K salary? Save $1,000/month ($833 debt, $167 invest). Tools: YNAB (You Need A Budget) app ($14.99/month or $99/year)—users cut debt 30% faster[expert reviews]. Or free: Undebt.it calculator simulates payoffs.

Current product: SoFi Debt Payoff Loan—refinance at 8-15% APR (as low as 9.99% for excellent credit, Feb 2026 rates). Consolidate $15K cards into one payment, save $3K interest over 3 years. Apply now—rates rising per latest NerdWallet trends.

Timeline Example: $20K high-interest debt at $1K/month = 24 months. Net worth jumps $15K instantly (less liability).

Milestone 2: Snag Free Money—Max Employer 401(k) Match (Months 1-3)

Don’t leave 50-100% returns on the table! Vanguard reports average match = 4.7% of salary[5]. Fidelity 401(k) or Vanguard Target Retirement Funds (expense ratio 0.08%, 2026 returns ~7-10% expected) auto-invest in S&P 500 trackers like VFINX.

Urgency: Matches vest—enroll before Q1 2026 deadlines or lose out. Example: 5% match on $60K salary = $3K free/year. Contribute minimum 5-6%, pay debt with rest. White Coat Investor: “#1 priority—beats any debt payoff”[4].

Milestone 3: Build the Hybrid Engine—Debt Payoff + Investing (Hit $25K Net Worth by Year 3)

Low-interest debt (<6%)? Invest aggressively. Mortgage at 3.5% or student at 4%? Expected stock returns 7-10% post-inflation win[1][2]. Split extra cash: 60% debt, 40% invest.

Savings Rate Ramp-Up: 25-40%

$70K income? $1,500-2,300/month. Pros/Cons Table:

| Option | Pros | Cons | 2026 Yield/Rate |

|---|---|---|---|

| Pay Off 4% Student Loan | Guaranteed 4% return, stress relief | Less liquidity | 4% |

| Invest in Vanguard VTI ETF | 10% historical avg, liquid | Market risk | ~8% expected |

| Schwab HYSA | 5.2% APY safe | Inflation lag | 5.2% |

Expert opinion: Practice Financial Group—invest if ROI > debt rate; client with 1.5% loans invested for higher returns[1]. Recent trend: 2026 Fed cuts make low-rate debt cheap to carry[3].

Action Steps:

- Open Robinhood Roth IRA (no fees, fractional shares)—buy VOO (S&P 500) at $500 minimum.

- Consolidate via Laurel Road Student Loan Refi (3.99% variable, doctors get 3.15%).

- Use NerdWallet calculator: Input salary/debt, get custom plan.

Milestone 4: Accelerate to $100K—Side Hustles & Automation (Years 4-5)

Now debt minimal, ramp investing to 15-20% returns via real estate or stocks. Example Timeline ($50K start salary, 7% raises):

| Year | Debt Paid | Invested | Net Worth |

|---|---|---|---|

| 1 | $12K | $6K (+match) | $10K |

| 2 | $15K | $12K | $25K |

| 3 | $8K | $25K | $50K |

| 4 | $0 | $50K | $75K |

| 5 | $0 | $90K | $105K |

Assumes 8% returns[4]. Boost with DoorDash ($20/hr) or Upwork freelancing—add $500/month. Social proof: YouTube creator’s Jan 2026 update shows $50K net worth at 28 via this exact hybrid[8].

Automation: Acorns app ($3-5/month)—rounds purchases, invests spare change in portfolios beating inflation.

Your $100K Victory Lap: Common Pitfalls & Pro Tips

Avoid: Lifestyle creep—cap housing at 25% income. Expert rec: PNC Insights—hybrid frees cash flow fastest[3]. New York Life: Start investing early for compounding magic[7].

Final Call-to-Action: Pause now—calculate net worth, enroll in 401(k) match, apply for SoFi refi. Join 1M+ on r/financialindependence tracking to $100K. Your future self (richer by $100K) thanks you—start today before rates climb!

Unlock Full Article

Watch a quick video to get instant access.

Social Media