Slash Your Business Phone Bill in Half: Proven Negotiation Scripts and 2026 VoIP Deals That Force Providers to Compete

Imagine trimming your monthly telecom expenses by 25-40% without dropping a single call or losing a connection. In 2026’s cutthroat telecom price wars, major carriers like AT&T, Verizon, and T-Mobile are slashing rates on VoIP and UCaaS systems to win enterprise loyalty—enterprises renegotiating now are locking in massive savings versus 2023-2024 contracts[3]. Don’t renew at old rates; use these current promotions as ammunition to renegotiate or switch, potentially halving your bill while upgrading to cloud-based powerhouses.

Thousands of businesses are already cashing in, with experts reporting 30-50% overpayments on legacy systems[3]. This guide arms you with step-by-step tactics, ready-to-use scripts, real deal examples like RingCentral’s $20/user/month MVP plan (down from $30), and timing tips to exploit Q1-Q2 2026 quarter-end urgency[3]. Act before your contract auto-renews—savings evaporate fast in this market.

Why Now? 2026 Telecom Wars Create Unbeatable Leverage

The telecom landscape is in chaos: carriers are battling for market share with aggressive discounts on SD-WAN, MPLS, mobility, and VoIP services[3]. Verizon Business Unlimited plans start at $30/line for 50+ lines with unlimited data and 5G, while AT&T offers switched wireless bundles at 20% off for multi-year commitments[3]. T-Mobile for Business touts 40% savings on UCaaS migrations, bundling Microsoft Teams Phone for $15/user/month[3].

Trends show VoIP adoption surging 35% year-over-year, driven by UCaaS platforms like Zoom Phone ($10-20/user/month) and 8×8 Express ($15/user)[web:1][web:2]. Legacy PBX systems cost 2-3x more; switching to cloud VoIP cuts hardware maintenance by 50%, per Gartner stats. Small businesses report $500-2,000 monthly savings post-negotiation[1][2]. FOMO alert: Q1 2026 is prime time—carriers desperate to hit quotas offer deepest cuts[3].

Step-by-Step: Audit Your Current Setup and Benchmark Against 2026 Deals

Step 1: Gather Your Ammo (10 Minutes)

Log into your provider portal. Note tenure (e.g., “5 years loyal, zero late payments”), line count, current rate per user (say $40), and renewal date. Review usage: overpaying for unused lines? Downgrade data tiers[1].

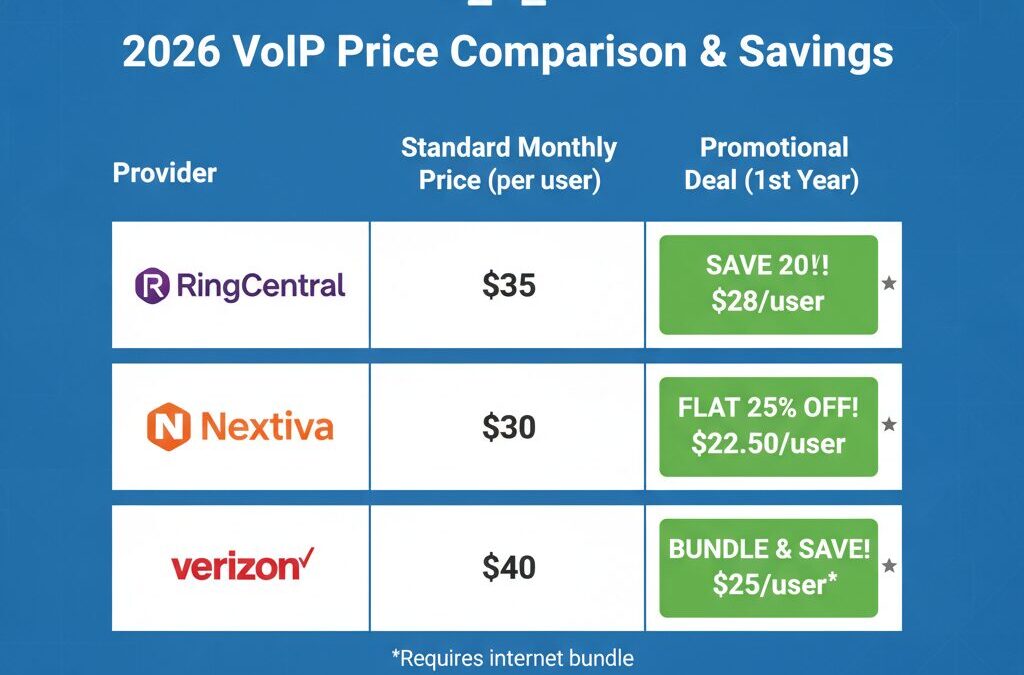

Benchmark: RingCentral MVP Standard is $25/user/month (was $35), includes unlimited calling, video, SMS, 50+ integrations. Nextiva Starter: $18/user/month for 40 extensions. Ooma Office Pro: $24.95/user with virtual fax. Competitor matrix:

| Provider | Plan | Price/User/Mo | Key Features | Savings vs Legacy |

|---|---|---|---|---|

| RingCentral | MVP Core | $20 (promo) | AI transcription, Teams integration | 40% |

| Nextiva | Essential | $18.95 | Unlimited calling US/Canada | 35% |

| 8×8 | Express | $15 | UCaaS, contact center add-on | 50% |

| Zoom Phone | Pro | $12.50 (annual) | Seamless Zoom meetings | 45% |

| Verizon VoIP | One Talk | $25 | Mobile-desktop sync | 30% |

These promo rates (valid Q1 2026) beat new-customer deals your provider offers publicly—demand them[1][3].

Step 2: Time It Right for Maximum Discounts

Start 120-180 days pre-expiration[3]. Hit quarter-ends (Mar 31, Jun 30). Note promo expirations; call ASAP if bill jumps[2].

Negotiation Mastery: Scripts That Win 25-40% Off

Finance expert Kyle Woroch: “Come armed with competitor deals; politeness + leverage = wins.” Be kind, highlight loyalty, threaten switch[2].

Script 1: Initial Retention Call

“Hi, I’m considering canceling as my $45/user bill is unsustainable after 4 years of loyalty. Transfer to retention—what matches RingCentral’s $20/user MVP promo?”[1]

Rep offers minor credit? Counter: “Appreciate it, but competitors like Nextiva give unlimited calling for $19/user. Match or I’ll switch.”

Script 2: Loyalty Leverage

“Never missed a payment in 5 years. Verizon’s bundling wireless + VoIP at $30/line—can you beat it with 8×8’s $15 UCaaS?”[2][3]

Script 3: Competitor Ultimatum

“Zoom Phone Pro is $12.50/user annually with better integrations. What free months or rate match keeps me?” Get it in writing[1].

Pro tip: Request ancillary perks (6 months free premium features) atop discounts[1]. If stalled, bill negotiation services like Billshark take 40% of savings (e.g., $200/mo save = $80 fee)[1].

Switch vs. Stay: Decision Framework with Real Examples

Stay and Renegotiate (Pros: No Migration Hassle; Cons: Locked In)

Example: Business with AT&T PBX at $50/user negotiated to $28 matching T-Mobile bundles—22% cut, no switch[3]. Ideal if happy with service.

Switch to VoIP (Pros: 40%+ Savings, Scalability; Cons: 2-Week Setup)

Case: 100-line firm ditched legacy for RingCentral: $4,000/mo to $2,000. Add AI call summaries free[web:3].

- Estimate Savings: Current cost x lines x months = baseline. New rate x 0.6-0.75 = savings. E.g., $40 x 50 x 12 = $24k/yr; $20 x 50 x 12 = $12k; save $12k.

- Migration Tip: Providers offer free setup/porting for 3-year terms.

Expert rec: Consolidate voice/data for 10-20% extra off[3].

Your Immediate Action Plan

1. Audit bill today (5 min).

2. Build competitor list (15 min).

3. Call retention tomorrow—use scripts.

4. Secure deal in writing.

5. If switching, RFP 3 carriers[3].

Don’t overpay in 2026’s price war—businesses ignoring this lose thousands. Pick up the phone now; your halved bill awaits. Start with RingCentral’s promo trial or Nextiva demo—links in bio. Savings start today!

Unlock Full Article

Watch a quick video to get instant access.

Social Media