The 2026 Estate Tax Game-Changer: How High-Net-Worth Families Are Locking In $15M Tax-Free Transfers Before Rules Shift Again

If you’ve built substantial wealth—whether through real estate, business ownership, or investment portfolios—2026 marks a critical inflection point for your family’s financial future. The rules governing how much you can pass to your heirs tax-free just fundamentally changed, and the window to act strategically is narrower than you might think.

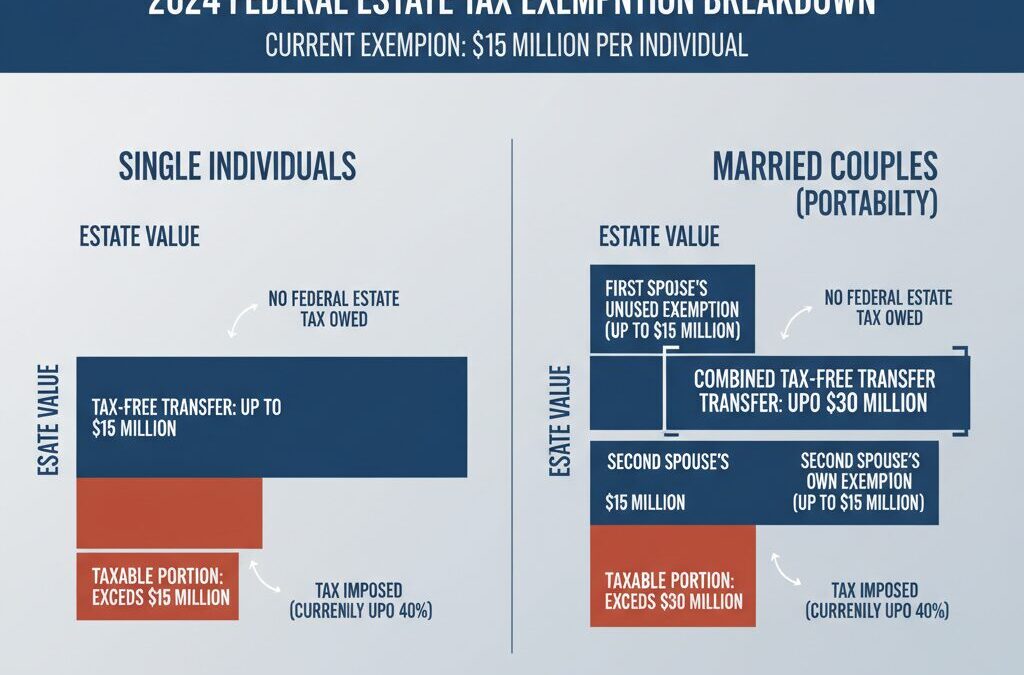

Here’s what just happened: The One Big Beautiful Bill Act (OBBBA) permanently locked in a $15 million federal estate and gift tax exemption per individual ($30 million for married couples) starting January 1, 2026, with annual inflation adjustments going forward[2][3][6]. This represents a seismic shift from what was supposed to happen—a catastrophic drop to $5-7 million per person that would have triggered a tax crisis for high-net-worth families nationwide.

But here’s the catch: while this new exemption is permanent, the tax landscape remains volatile. Future administrations can change the rules again. That’s why estate planning professionals are calling 2026 the year of “use it strategically or regret it.”

Understanding the New $15 Million Exemption: What Changed and Why It Matters

For decades, the federal estate tax exemption has been a moving target. The Tax Cuts and Jobs Act of 2017 (TCJA) temporarily doubled it to nearly $14 million per person, but with a sunset clause—meaning it was scheduled to revert to $5 million (adjusted for inflation, roughly $7 million) at the end of 2025[1][7]. This created massive uncertainty and urgency for wealthy families planning multi-generational transfers.

The OBBBA eliminated that sunset provision entirely. Starting January 1, 2026, the exemption is $15 million per person, indexed annually for inflation[2][3][5]. For married couples, this means $30 million can transfer tax-free during life or at death. The federal estate tax rate on amounts exceeding the exemption remains 40%[3][5].

What makes this genuinely significant: The exemption is now permanent, not subject to political flip-flopping every few years. However, high-net-worth families understand that “permanent” in legislative terms doesn’t mean permanent in perpetuity. Future administrations could theoretically reduce exemptions again[3]. This permanence is valuable, but it’s not a guarantee carved in stone.

The Urgency Factor: Why 2026 Is Your Planning Window

You might think: “If the exemption is now permanent and higher, what’s the rush?” The answer lies in asset appreciation and strategic timing.

Every dollar of appreciating assets you transfer today removes not just that dollar, but all future growth, from your taxable estate[2][4]. If you own a family business, commercial real estate, or a diversified investment portfolio, waiting even 12-24 months could mean transferring significantly more value into the taxable portion of your estate.

Consider this practical scenario: You own a commercial real estate portfolio valued at $18 million. Under the new $15 million exemption, $3 million is immediately exposed to potential 40% federal taxation—that’s $1.2 million in taxes before state-level taxes even enter the picture. But if you strategically gift $3 million to an irrevocable trust today, that asset and all its future appreciation are permanently outside your taxable estate. If that property appreciates 5% annually, in 10 years you’ve protected an additional $1.5 million from taxation[2][4].

Strategic Tools High-Net-Worth Families Are Using Right Now

1. Irrevocable Trusts and Asset Gifting

The most direct strategy is gifting assets to irrevocable trusts before year-end. Once assets are in an irrevocable trust, they’re permanently removed from your taxable estate, along with all future appreciation[2][4]. This is particularly effective for appreciating assets like business interests, real estate, or growth-oriented investment portfolios.

You can gift up to your $15 million exemption without triggering federal gift tax. Annual exclusion gifts ($19,000 per recipient in 2025) don’t count against your lifetime exemption, allowing you to transfer additional wealth tax-free each year[7].

2. Spousal Lifetime Access Trusts (SLATs)

SLATs allow one spouse to fund a trust for the benefit of the other spouse (and eventually children or grandchildren) while removing assets from the taxable estate[4]. The funding spouse gets the satisfaction of knowing their spouse has access to the trust assets, but the trust itself—and all its growth—is outside their taxable estate. For married couples with $30 million exemptions, SLATs provide sophisticated wealth transfer opportunities.

3. Intentionally Defective Grantor Trusts (IDGTs)

IDGTs allow you to sell appreciating assets to a trust at fair market value (using an IRS rate called the Applicable Federal Rate). You receive installment payments, but the asset’s future appreciation benefits the trust beneficiaries, not your taxable estate. This is particularly powerful for family businesses or real estate expected to appreciate significantly.

4. Delaware Dynasty Trusts and Multi-Generational Planning

With the generation-skipping transfer tax exemption also raised to $15 million, families can now structure trusts that benefit grandchildren and beyond without triggering additional taxes[5]. Delaware Dynasty Trusts, in particular, offer perpetual trust structures with asset protection and tax advantages, allowing wealth to compound across multiple generations outside the federal tax system[2].

5. Valuation Discounts for Business and Real Estate

High-net-worth families with significant business interests or real estate portfolios can leverage valuation discounts when transferring ownership interests. Minority interest discounts, lack-of-control discounts, and lack-of-marketability discounts can reduce the taxable value of transferred assets by 20-40%, effectively stretching your exemption further[2].

Engaging Professional Estate Planning Services: What You Need

This is not a DIY situation. The complexity of coordinating trusts, valuation strategies, multi-state considerations, and business succession planning requires a coordinated team.

High-net-worth families should engage:

Estate Planning Attorneys: Specialized attorneys draft trusts, fund them properly, and ensure compliance with state and federal law. Expect to pay $5,000-$25,000+ for comprehensive estate planning for high-net-worth clients, depending on complexity.

Tax Advisors and CPAs: They model the tax implications of different strategies, ensure proper valuation of assets, and coordinate with your attorney on implementation.

Financial Advisors: They help identify which assets to transfer, structure investment strategies within trusts, and coordinate with your broader wealth management plan.

Business Succession Planners: If you own a business, specialized advisors help structure ownership transfers, fund buy-sell agreements, and plan for management transitions.

The investment in professional guidance—$20,000-$50,000 for comprehensive planning—is trivial compared to the $1.2 million+ in taxes you can avoid for a moderately sized estate[2][4].

The State Tax Wildcard: Don’t Forget Local Implications

Federal exemptions are only half the story. Several states impose their own estate or inheritance taxes with far lower exemptions. New York, Massachusetts, and Connecticut have state exemptions below $7 million[1][4]. If you own property or have beneficiaries in these states, you face additional tax exposure beyond federal taxes.

Some families strategically relocate to no-estate-tax states like Florida before implementing major transfers, removing future state tax exposure[4]. This requires careful planning to avoid adverse tax consequences, but for multi-million-dollar estates, it can save hundreds of thousands in taxes.

Your Action Plan: What to Do Before Year-End

Step 1: Get a complete inventory of your assets and their current values. Include real estate, business interests, investment accounts, insurance policies, and retirement accounts.

Step 2: Meet with an estate planning attorney to discuss your goals. Do you want to maximize tax-free transfers? Protect assets from creditors? Provide for charitable giving? Ensure business continuity?

Step 3: Work with your CPA to model different strategies and their tax implications. Some strategies are more efficient than others depending on your specific situation.

Step 4: Implement chosen strategies before year-end. Trusts need to be properly drafted, funded, and documented. Gifts need to be made and reported correctly.

Step 5: Review and update your plan annually. The $15 million exemption increases each year for inflation. Your personal circumstances change. Your plan should evolve accordingly.

The Bottom Line: Act With Intention, Not Panic

The new permanent $15 million exemption is genuinely favorable compared to what was feared. But it’s not a reason to delay. Every month you wait, appreciating assets grow larger and become exposed to future taxation. Every year the exemption increases for inflation, but so do your assets.

High-net-worth families that act strategically in 2026—with professional guidance, clear intentions, and proper documentation—will preserve substantially more wealth for their heirs and causes they care about. Those that delay or ignore the planning opportunity will watch millions flow to the IRS instead of their families.

The window is open. The rules are clear. The stakes are enormous. Now is the time to move.

Unlock Full Article

Watch a quick video to get instant access.

Social Media