Most founders obsess over cutting SaaS costs, negotiating vendor contracts, and squeezing margins—then casually put six- or seven-figure annual spend on a business card that gives them pennies on the dollar.

The result? Many growing companies quietly burn $5,000–$25,000 a year in lost rewards value simply because they chose the wrong rewards structure: cash back, flexible points, or travel-focused perks.

This isn’t about picking a “cool” card. It’s about choosing the rewards engine that puts the most actual money back into your business based on how you spend.

First Filter: Know Your Spend Before You Chase Any Welcome Bonus

Before looking at specific cards, you need a one-page snapshot of your last 12 months of business expenses:

- Digital ads (Google, Meta, LinkedIn, programmatic)

- SaaS + software + cloud (Salesforce, HubSpot, AWS, Azure, GCP)

- Travel (airfare, hotels, rideshare, trains)

- Fuel and fleet (gas, diesel, charging)

- Everyday ops (restaurants, supplies, shipping, phones)

Once you know where the bulk of your spend lives, you can match it to three reward structures:

- Flat cash back (simple, predictable)

- Flexible points (best when you redeem smartly)

- Premium travel rewards (outsized value if you travel and use perks)

Option 1: Cash Back – The “Silent Profit Margin” Card

Cash-back business cards convert spend directly into money you can redeploy into ads, payroll, or runway. No charts, no transfer partners, no brain damage.

Three current examples illustrate how this plays out in 2026:

Straightforward, No-Fee Workhorses

Bank of America Business Advantage Unlimited Cash Rewards Mastercard earns 1.5% cash back on all purchases with a $0 annual fee.[1][3] Businesses in Bank of America’s Preferred Rewards for Business can boost that effective rate up to 2.625% on all spend depending on deposit/investment balances.[2][3]

American Express Blue Business Cash Card offers 2% cash back on eligible purchases up to $50,000 per year, then 1% thereafter, with no annual fee and automatic statement credits.[3] It also includes Expanded Buying Power, which lets you flex above your limit based on payment history—useful for spiky ad or inventory months.[3]

U.S. Bank Triple Cash Rewards Visa Business Card gives up to 3% cash back on gas, office supplies, and cell phone/service provider purchases, 1% on other spend, plus a $0 annual fee and an intro 0% APR period.[1]

Cash Back in Real Dollars

Assume you spend $300,000 per year and do not travel much:

- Amex Blue Business Cash at 2% on the first $50k, then 1%:

($50,000 × 2%) + ($250,000 × 1%) = $1,000 + $2,500 = $3,500 back - BoA Unlimited Cash at 1.5%:

$300,000 × 1.5% = $4,500 back - BoA Unlimited Cash with Preferred Rewards for Business max tier at 2.625%:

$300,000 × 2.625% = $7,875 back

If your goal is pure profit and your team rarely leaves the office, cash-back cards—especially relationship-boosted ones like Bank of America’s—often beat points and travel by a wide margin.

Option 2: Flexible Points – Best for Ad-Savvy, SaaS-Heavy, or Online-First Businesses

Flexible points programs are where things get interesting. You earn a points currency, then redeem it for cash, statement credits, or travel through a portal or via transfer partners. Used well, the value per point is often higher than straight cash back—especially when redeemed for flights and hotels.

According to recent 2026 evaluations of business cards, The Points Guy values popular transferable currencies around 1.8–2.0 cents per point when used smartly for travel.[2]

Current Standouts for Flexible Points

American Express Business Gold Card:

- 4X Membership Rewards points on the top two categories where your business spends the most each month, from a list including online, TV and radio advertising, gas, restaurants, transit, shipping, and U.S. electronics/software/cloud providers.[2][5]

- 4X is capped at $150,000 in combined purchases per year, then 1X.[2]

- Annual fee around $375 as of 2026, with welcome offers often in the ~100,000-point range.[5]

Amex Blue Business Plus:

- 2X Membership Rewards points on the first $50,000 in purchases per year, then 1X.[2]

- No annual fee, effectively giving about a 4% return (at 2 cents per point) on the first $50k.[2]

Other issuers also offer strong flexible-points designs, but these two illustrate the math for ad- and SaaS-heavy companies.

Points vs Cash: The Ad-Spend Startup Example

Say your performance marketing agency spends $60,000 per month on social + search ads, plus $15,000 per month on SaaS and cloud—roughly $900,000 per year.

If most of that falls into Amex Business Gold 4X categories (ads, software, cloud):

- First $150,000 at 4X = 600,000 points

- Remaining $750,000 at 1X = 750,000 points

- Total: 1,350,000 points

At a conservative 1.5 cents per point via travel redemptions, that’s worth about $20,250. At 2 cents, it’s $27,000 in travel value.

Compare that with a simple 2% cash-back card on the same $900,000 spend:

- $900,000 × 2% = $18,000 cash

On paper, the points card can beat pure cash if you consistently redeem for high-value travel.

If you only ever redeem points as a statement credit at roughly 1 cent per point, that same 1,350,000 points is just $13,500—suddenly, you’d have been better off with a strong cash-back card.

Option 3: Travel-Powerhouse Cards – When You Fly Often and Use the Perks

Premium business travel cards are designed for teams that live in airports and hotel lobbies. In 2026, standout options include products like the Chase Sapphire Reserve for Business and the Capital One Venture X Business, which are consistently cited as top picks for heavy business travelers.[2]

The Sapphire Reserve for Business, for example, offers:

- 8X points on hotels and car rentals booked through the issuer’s travel portal, and 4X points on flights and hotels booked direct.[2]

- Huge welcome bonus: around 200,000 points after $30,000 spend in 6 months, with first-year value modeled at $6,500+ when including ongoing perks.[2]

On the ultra-premium side, The Business Platinum Card from American Express carries an annual fee close to $895 but offers extensive statement credits—Adobe, Indeed, wireless, and more—plus airport lounge access and elevated points on key business categories.[1][2]

Travel Card Math: When Does It Beat Cash Back?

Assume your company spends per year:

- $200,000 on flights and hotels

- $150,000 on other expenses

If those $200,000 in travel bookings earn an average of 4X points through a premium travel card:

- Travel: $200,000 × 4X = 800,000 points

- Other: $150,000 × 1X = 150,000 points

- Total: 950,000 points

Redeemed at 1.5–2.0 cents per point towards premium flights/hotels, that’s $14,250–$19,000 in travel value.

Now compare with a 2% cash-back setup on the same $350,000 spend:

- $350,000 × 2% = $7,000 cash

Even after subtracting a high annual fee (say $695–$895) on a premium travel card, you’re still materially ahead if you value travel redemptions close to cash and actually use the benefits (lounge access, credits, elite status boosts).

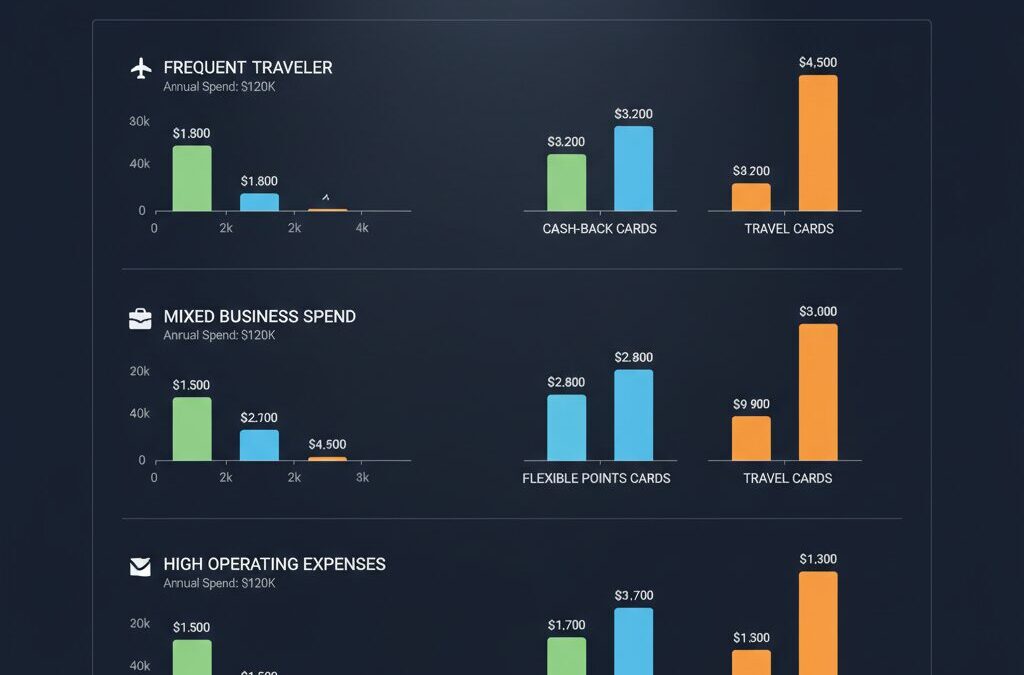

Which Rewards Structure Wins for Your Business Type?

1. Local or Service Businesses with Low Travel

Examples: agencies with local clients, professional services, trades, small e-commerce with minimal travel.

Your priorities:

- Maximize net dollars back

- Keep systems simple for your bookkeeper

Best fit:

- Flat or tiered cash back with no or low annual fee

- Consider Bank of America Business Advantage Unlimited Cash if you can qualify for Preferred Rewards for Business to reach up to 2.625% back.[2][3]

- Pair with Amex Blue Business Cash for an easy 2% on the first $50k if you want to split exposure.[3]

2. Ad-Heavy, SaaS-Heavy, or Online-First Companies

Examples: DTC brands, digital agencies, B2B SaaS, info-product businesses.

Your priorities:

- Very high ad and software spend

- Founders or execs who can use premium travel

Best fit:

- Amex Business Gold for 4X on your top two categories (often ads + software/cloud), up to $150k per year.[2][5]

- Blue Business Plus as a no-fee backup for 2X on up to $50k of miscellaneous spend.[2]

- Redeem primarily for travel at 1.5–2.0 cents per point equivalent; otherwise, you’re better off with cash back.

3. Sales-Driven Teams Constantly on the Road

Examples: enterprise sales orgs, consulting firms, distributed teams meeting clients worldwide.

Your priorities:

- Multiple staff flying and staying in hotels monthly

- Need for airport lounges, status, and flexibility

Best fit:

- A premium travel business card (e.g., Sapphire Reserve for Business or Business Platinum) for airfare and hotels.[2]

- Layer a no-fee cash-back card (BoA, Blue Business Cash) for non-travel spend.

Fast, Actionable Setup: A 3-Step Playbook You Can Implement This Week

Step 1: Audit Last 12 Months of Spend

- Export card and bank transactions to a spreadsheet.

- Tag each line item into 5–7 major categories (ads, SaaS, travel, fuel, ops, etc.).

- Calculate your top two categories by total dollars.

Step 2: Pick a Primary Rewards Engine

- If travel < 10% of total spend: prioritize a high-yield cash-back card, especially if you can qualify for boosted relationship tiers.[1][2][3]

- If ads + SaaS are dominant: anchor on a flexible points card like Amex Business Gold, and commit to learning one or two high-value redemption paths.[2][5]

- If travel is a major line item: choose a premium travel card with strong earn rates and benefits that your team will actually use.[2]

Step 3: Layer a Secondary Card to Plug the Gaps

- Use a no-fee 2% cash-back or 2X points card for non-bonus categories (e.g., Blue Business Cash or Blue Business Plus).[2][3]

- Route specific categories (like gas or cell phone) to a card that offers 3%+ if it’s meaningful in your budget.[1][3]

- Set clear rules for your team: which card for ads, which for travel, which for everything else.

Stop Treating Rewards as a Perk – Treat Them as a Revenue Line

The difference between a generic 1% setup and a tuned rewards stack can easily be $10,000–$30,000 per year for a mid-sized business. Over five years, that’s a new hire, a product launch, or a meaningful chunk of your marketing budget.

The key is alignment:

- Cash back if you want simplicity and direct profit.

- Flexible points if you’re ad/SaaS heavy and can master high-value redemptions.

- Travel rewards if you live on the road and will use the perks aggressively.

Run the numbers on your last 12 months of spend today. Then choose (or adjust) your primary card based on where your dollars actually go—not where the flashiest bonus is. Every statement cycle you delay is more money you’re gifting back to the bank instead of compounding inside your company.

Unlock Full Article

Watch a quick video to get instant access.

Social Media